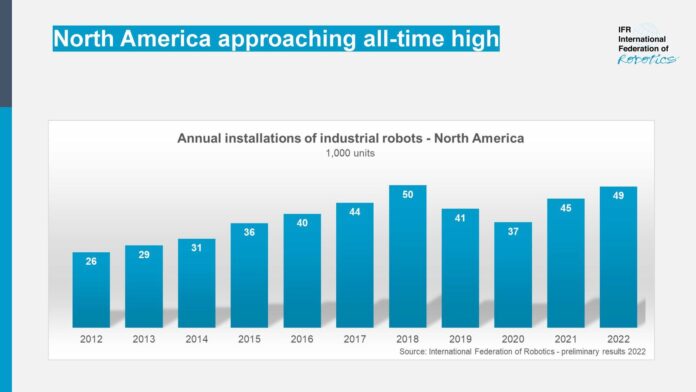

The North American robotics market showed strong growth: Total installations in manufacturing rose by 12% and reached 41,624 units in 2022. Number one adopter is the automotive industry: companies based in the US, Canada and Mexico installed 20,391 industrial robots – up 30% compared to 2021. These are preliminary results, presented by the International Federation of Robotics (IFR).

“North America represents the second largest operational stock of industrial robots in the world after China,” says Marina Bill, President of the International Federation of Robotics (IFR). “The United States, Canada, and Mexico are key markets in the global growth of robotics automation, and the automotive sector is leading the way.”

Cyclical demand from automotive

In the United States, demand from car makers and manufacturers of components rose by 48% in 2022. Installations thus display the cyclical demand pattern well-known from this customer segment. After a few years of contraction, down from the peak level of 15,397 units in 2017 to 9,854 units in 2021, installations surged to 14,594 units in 2022.

Installation counts in Canada largely depend on investments of the automotive industry that accounts for 40% of robot installations. Sales to automotive declined by 36% with 1,258 units installed in 2022. This is below the pre-pandemic level of 1,897 units in 2019. The robot installations to manufacture parts and accessories for motor vehicles were significantly down by 45% with 995 units sold. Motor vehicles, engines and bodies on the other hand grew by 99% with 263 units sold.

Robot installations in Mexico are also determined by the automotive industry that accounted for 66% of the robot installations in 2022: Sales grew by 16% and reached 4,222 units in 2022 – the second best result since the peak level of 4,805 units in record year 2017.

Non-automotive sectors

Installation counts in other industries exceeding the 4,000-unit mark in North America are: electrical/electronics (+28%), metal and machinery (-9%), and plastic and chemical products (-4%). They each represent a 9% market share of industrial robot installations in 2022.

AUTOMATE trade show

Automate, the largest robotics and industrial automation trade show in North America, will return in 2024 and then continue as an annual event, the Association for Advancing Automation (A3) announced. McCormick Place in Chicago will host next year’s event May 6-9, 2024, and in 2025 the show will be back in Detroit.

About IFR

The International Federation of Robotics is the voice of the global robotics industry. IFR represents national robot associations, academia, and manufacturers of industrial and service robots from over twenty countries.

The IFR Statistical Department provides data for two annual robotics studies:

World Robotics – Industrial Robots: This unique report provides global statistics on industrial robots in standardized tables and enables national comparisons to be made. It presents statistical data for around 40 countries broken down into areas of application, customer industries, types of robots and other technical and economic aspects. Production, export and import data is listed for selected countries. It also offers robot density, i.e. the number of robots per 10,000 employees, as a measure for the degree of automation.

World Robotics – Service Robots: This unique report provides global statistics on service robots, market analyses, and forecasts on the worldwide distribution of professional and personal service robots. The study is jointly prepared with our partner Fraunhofer IPA, Stuttgart.

Follow IFR on LinkedIn, Twitter and YouTube